What is Chatbot Market Size?

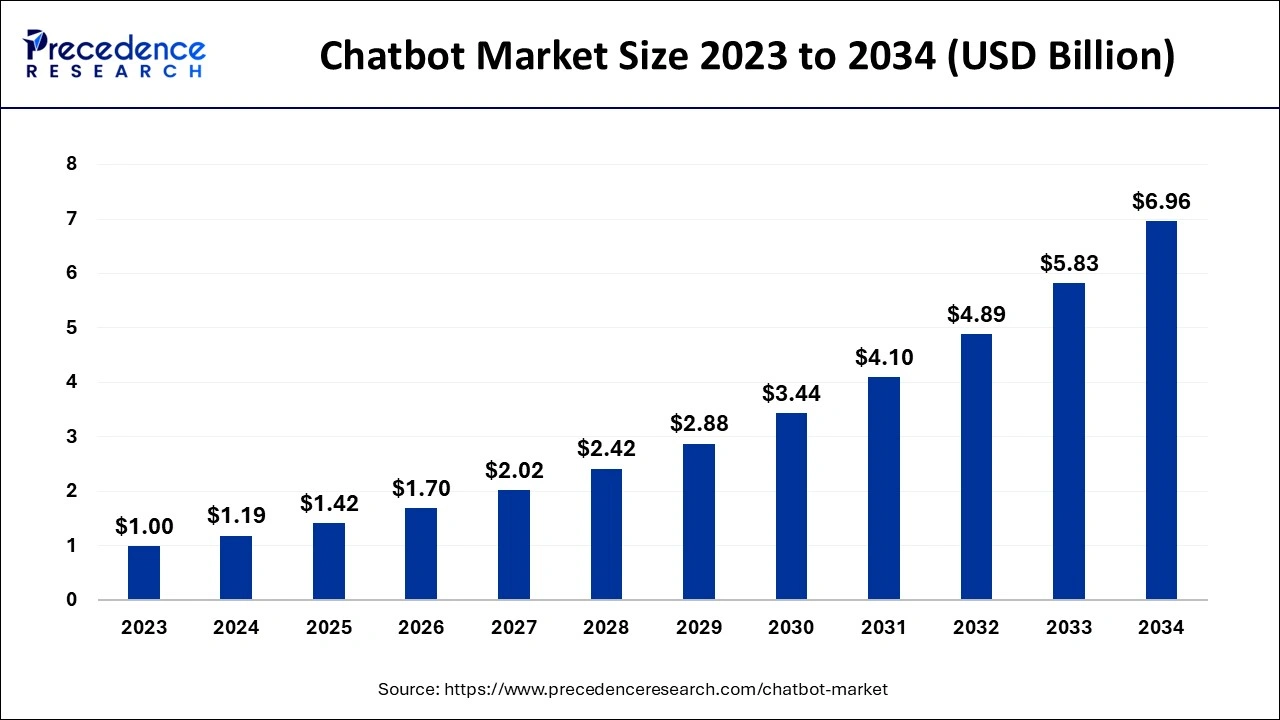

The global chatbot market size is calculated at USD 1.42 billion in 2025 and is predicted to increase from USD 1.70 billion in 2026 to approximately USD 7.96 billion by 2035, expanding at a CAGR of 18.81% from 2026 to 2035.

Market Highlights

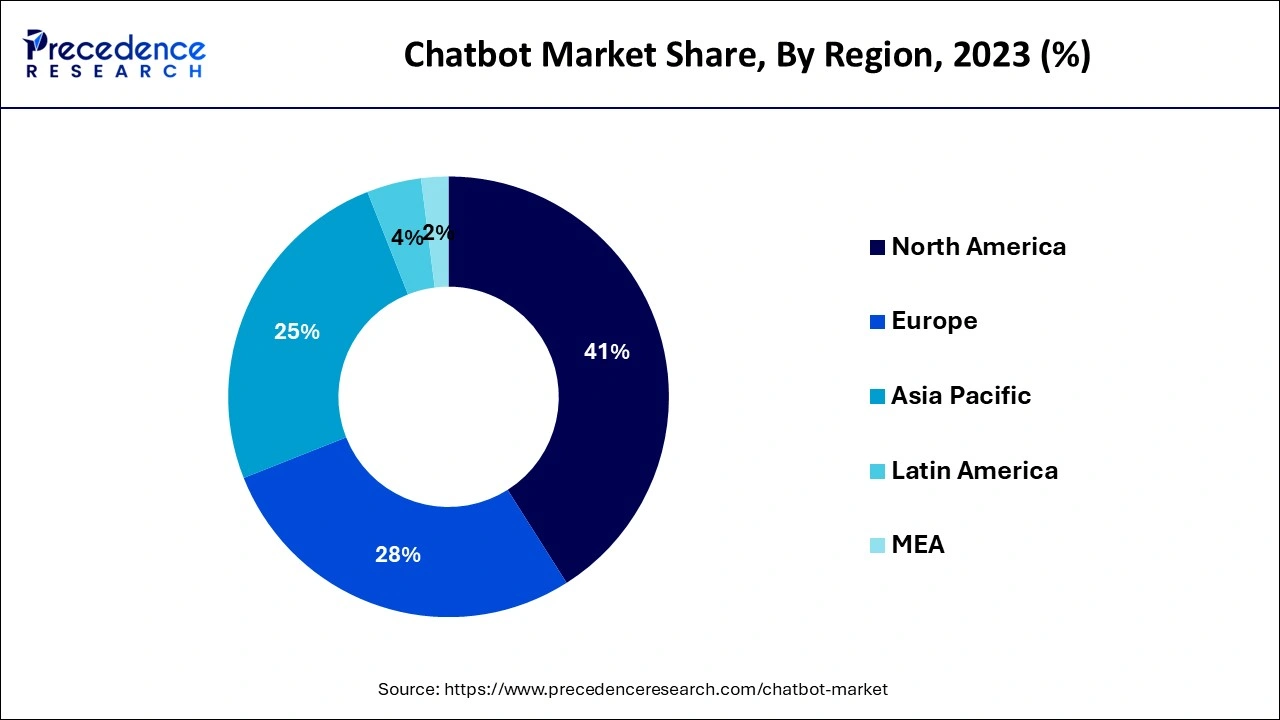

- By geography, the North America generates the highest market share of around 41% in 2025.

- By end user, the large enterprises segment captured the highest market share of around 51% in 2025.

- By application, the bot-for-service segment generates more than 36% revenue share in 2025.

- By type, the standalone segment captured the largest market share of around 55.70% in 2025.

- By product, the marketing segment generates for the largest market share of around 56% in 2025.

- By vertical, the eCommerce segment generates for the largest market share of around 21% in 2025.

Market Size and Forecast

- Market Size in 2025: USD 1.42 Billion

- Market Size in 2026: USD 1.70 Billion

- Forecasted Market Size by 2035: USD 7.96Billion

- CAGR (2026-2035): 18.81%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

A chatbot is a computer program that usesartificial intelligence(AI) and natural language processing (NLP) to understand customer queries and automate responses, stimulating human conversation. Chatbots help to reduce operational costs while increasing overall efficiency. Chatbots have introduced several advantages, including 24x7 support and parallel discussions. The market is expected to be driven by several innovations in artificial intelligence and machine learning technologies.

How is AI Influencing the Chatbot Industry?

AI is transforming the chatbot industry by shifting from rigid, rule-driven systems to intelligent, conversational, and generative models. These advanced bots use natural language processing (NLP) as well as machine learning to offer 24/7, context-aware support, increasing efficiency, reducing expenses, and improving user experiences across numerous industries. Businesses utilize AI to deliver tailored product recommendations, personalized experiences, and, for live agents, real-time customer data.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.42 Billion |

| Market Size in 2026 | USD 1.70 Billion |

| Market Size by 2035 | USD 7.96 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.81% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By End User, By Application, By Type, By Product and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The surge in demand for uninterrupted customer assistance

A chatbot is a computer program that imitates human conversations with users through text messages on chat to respond to queries, provide product information and perform other functions. Many companies are experimenting with digital customer service platforms to replace traditional customer service methods, and they can respond to customer inquiries and automate routine tasks. Due to their ability to process large amounts of data and react quickly to online communication between companies and consumers, chatbots are gaining popularity in digital businesses.

According to a research study, 32% of customers expect a reply within 30 minutes, and 50% of user requests return unsettled, while 52% of customers hang up on representatives from customer service before their issue is resolved. This implies that customers expect customer service departments to respond quickly to their questions, or companies risk losing such customers.

The increased use of chatbot technology aids in customer relationship management (CRM), and it also helps to improve response time, which reduces workload. Integration of machine learning and natural language processing (NLP) with conversational AI chatbots aids in understanding human communication, reduces customer churn, and provides 24/7 support to boost sales and lead generation.

Chatbots are now considered an essential component of any customer service solution. According to Outgrow infographics, they are increasing the use of chatbots resulting in a more than 30% reduction in customer service operatis. As a result, 69% of users prefer to use chatbots to get quick answers to common questions.

Restraint

Lack of awareness

Lack of awareness and other challenges, such as complex chatbot management, may obstruct market growth and hamper the global chatbot market throughout the forecast period. Furthermore, awareness about the benefits of AI chatbots may be necessary for worldwide adoption. Large organizations are adopting chatbot solutions; however, small and medium enterprises have limited the adoption due to high costs associated with their maintenance and a need for more skilled resources.

Opportunity

Rising adoption of self-learning chatbots to deliver a humanlike conversational experience

In recent years, businesses have been advancing the development of self-learning chatbots. As a result, they are implementing several integrated technologies, including cloud-based deployment, an interference engine, a natural language processor (NLP), and an application programming interface (API).

These self-learning chatbots can quickly adapt to changing environments and conditions as they can learn from previous conversations, actions, decisions, and experiences. Furthermore, businesses are collaborating to provide integrated self-service technology to customers. For instance, in February 2020, Creative Virtual announced a collaboration with Spitch AG to jointly develop speech recognition and conversational AI, particularly in omnichannel solutions. The partnership provides a multilingual voice bot to improve sales and customer experience. Thus, the above factors are expected to create favorable opportunities for the global chatbot market in the coming years.

Segment Insights

Product Insights

In 2025, the marketing segment accounted for the largest market share of about 56%. Chatbots use AI to process language and interact with humans. Many chatbots have been added to messenger apps like Facebook, Skype, Slack, and other social media networking sites. Moreover, chatbot programmers incorporate payment gateways directly with the associate and use these messaging platforms for payment services.

One of the market's significant opportunities is to charge nominal fees as commission. Furthermore, chatbots are widely used in digital marketing to keep existing customers informed about new products and services, even though they allow for direct customer interaction.

Type Insights

In 2025, the standalone segment accounted for the largest market share of about 55.70%. Consumers nowadays use visual assistant apps like Google Assistant, Amazon's Alexa, and Apple's Siri in standalone messaging platforms. This is expected to result in a significant increase in demand for standalone chatbots.

Application Insights

In 2025, the bot-for-service segment dominated the market holding the largest share of about 36%. In this era of automation, many businesses automate routine and mundane tasks to save money. Sales and customer service are the primary areas focusing on automating, which will significantly reduce costs by utilizing chatbots.

Chatbots powered by artificial intelligence a becoming increasingly popular. Chatbots in businesses will drastically reduce labor costs by automating a portion of customer service and sales, resulting in significant savings for businesses. Customers prefer quick responses from customer service over waiting days for an answer, and responding through a chatbot reduces the likelihood of losing a customer significantly. E-commerce companies can use chatbots for returns and exchanges.

Chatbot Market Share, By Vertical, 2022 (%)

| Vertical Segments | Revenue Share (2022) |

| Healthcare | 19.5% |

| Retail | 5.7% |

| Banking, Financial Services and Insurance (BFSI) | 15% |

| Media and Entertainment | 19.5% |

| Travel & Tourism | 13.8% |

| E-commerce | 21% |

| Others | 5.5% |

Vertical Insights

In 2025, the eCommerce segment accounted for the largest market share of about 21%. eCommerce chatbots are used for 'conversational commerce' or conversational interfaces, which include chatbots, online messaging, and voice assistants, among others, to provide clients with a fast and satisfying shopping experience.

Conversational commerce combines the convenience and efficiency of eCommerce portals with personalized service for customers. eCommerce bots are an effective lead-generation tool for merchants. Moreover, they engage pliant visitors on a retailer's app, website or other digital platforms with intelligent prompts and convert them into prospects. When shopping online, most customers look for deals and discounts.

An eCommerce chatbot can alert prospects to discounts and promotional offers through discount codes, and coupons, and/or redirect them to the appropriate sections of the portal.

End User Insights

In 2025, the large enterprises' segment accounted for the highest market share of about 51%. Multiple large enterprises build their chatbots with a set of rules and are expected to improve their chatbots in the future to achieve advanced operations. Most chatbot development tools are based on the machine learning model, allowing businesses to create an AI applications interface to deliver actionable business data.

Furthermore, market advancements in artificial intelligence have significantly shifted usage from online social networks to mobile-based messaging apps.

Regional Insights

What is the U.S. Chatbot Market Size?

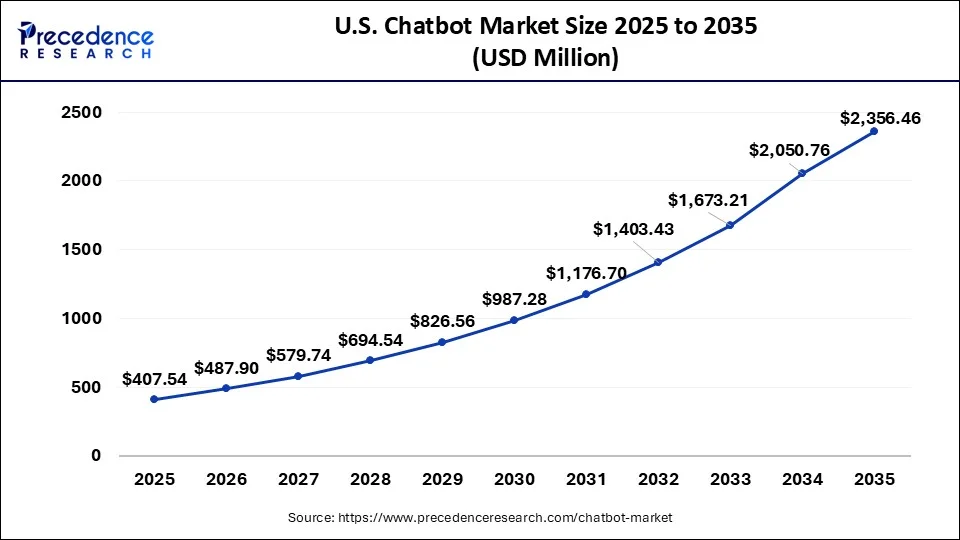

The U.S. chatbot market size is exhibited at USD 407.54 million in 2025 and is predicted to be worth around USD 2,356.46 million by 2035, growing at a CAGR of 19.18% between 2026 and 2035.

In 2023, North America dominated the global chatbot market with the highest market share of about 41% and was expected to continue to dominate during the forecast period. The rise in mobile and web-based chatbots' penetration across multiple platforms drives this growth. Increased adoption of chatbot technologies for effective customer engagement and improved customer service is also expected to drive the future market demand for chatbots in North America. The market in the US is expected to grow significantly due to the increased adoption of mobile applications and the lucrative presence of start-up vendors in the country.

U.S. Chatbot Market Trends

The U.S. chatbot market involves widespread adoption of AI for 24/7 customer service, a shift toward voice-driven, context-aware agents. Solutions, along with software, dominate the market, while mobile applications remain the main medium for deployment. Increasing integration with IoT apparatus, such as smart homes, voice-enabled cars, and real-time support, is a major trend.

Asia Pacific Chatbot Market: AI Adoption and Customer Engagement Trends

Asia Pacific is the fastest-growing market during the forecast period. It is driven by high usage in banking or fintech for 24/7 service, healthcare for patient interaction, and retail for personalized product recommendations. Chatbots are being embraced across numerous sectors, including retail, healthcare, banking, and telecommunications. Businesses are leveraging chatbots to offer instant customer support, manage inquiries, and even facilitate transactions.

Investment Opportunities in the European Chatbot Market

Europe's market shows significant growth during the forecast period. Europe AI Chatbot technologies allow better performance tracking as well as operational insights, helping businesses meet growing customer expectations. Improved service results also contribute to brand differentiation and customer retention.

Germany Chatbot Market Trends

Germany's market is driven by developments in artificial intelligence and the increasing need for automated customer service solutions. Businesses across numerous sectors are adopting chatbots to improve user engagement, streamline operations, and also reduce costs. This trend is particularly evident in the retail and banking industries, where firms are leveraging chatbots to offer instant support and personalized experiences.

Conversational AI and Chatbot Market in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by the explosion of online shopping, along with social commerce across the region, which has forced merchants to accept automated, real-time communication to handle high volumes of inquiries and customer support. Businesses are deploying chatbots to decrease operational costs, handle routine customer service tasks, and improve customer experience without increasing staff, addressing the demand for immediate support.

Brazil Chatbot Market Trends

Brazil's market is driven by high adoption rates of messaging platforms such as WhatsApp and a strong drive toward digital transformation across various sectors. With approximately 140 million users, WhatsApp is the main channel for chatbot deployment in Brazil, utilized for customer support, marketing, and sales, mainly in retail and finance.

Chatbot Market Companies

- IBM Corporation

- Microsoft

- AWS

- Oracle

- Acuvate

- Aivo

- Artificial Solutions

- Botsify Inc

- Creative Virtual Ltd.

- eGain Corporation

- Inbenta Technologies Inc.

- Next IT Corp.

- Nuance Communications, Inc.

Recent Developments

- In July 2022, Tata Consultancy Services (TCS) announced a collaboration with Walton Centre NHS Foundation Trust to begin the development of digital solutions that increase specialist productivity and decrease patient wait time. TCS is expected to create a novel AI-based chatbot that will change the diagnosis and treatment of patients with headaches at the Liverpool center.

- A WhatsApp-based chatbot was launched in May 2022 by Glenmark Pharmaceuticals. This chatbot will send reminders to patients regarding their treatment for the recommended duration. This was launched specifically for patients suffering from fungal infections. Glenmark in partnership with the Indian Association of Dermatologists, Venereologists, and Leprologists (IADVL), the digital patient education tool 'Hello Skin' was created.

- In Feb 2021, Nuance announced the acquisition of Saykara, Inc, a start-up focused on developing a mobile AI to automate clinical documentation for physicians. The acquisition underscores Nuance's ongoing market expansion and technical leadership in conversational AI and ambient clinical intelligence (ACI) solutions that reduce clinical burnout, enhance patient experiences, and improve the health system's financial integrity.

Segments Covered in the Report

By End User

- Small Enterprises

- Medium Enterprises

- Large Enterprises

By Application

- Bots for Service

- Bots For social media

- Bots For Payments/Order Processing

- Bots For Marketing

- Others

By Type

- Standalone

- Web-based

- Messenger-based/Third Party

By Product

- Artificial Intelligence

- Marketing

- Human Intelligence

By Vertical

- Healthcare

- Retail

- Banking, Financial Services and Insurance (BFSI)

- Media and Entertainment

- Travel & Tourism

- E-commerce

- Others

ByRegion

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content